Fintech is revolutionizing how financial services are delivered. From trading platforms to mobile banking apps, the demand for custom-built fintech solutions is rapidly increasing. Whether you’re a startup or an established business, starting a fintech development project requires careful planning and execution.

At DC technolabs, we understand the complexities of fintech development, and we aim to guide you through the essential steps to ensure your project’s success.

Identifying Fintech Project Requirements

The first step in fintech development is identifying your project’s key requirements. These can include:

- Target Audience: Who will be using your product? Are they retail users, businesses, or big investors?

- Core Features: What essential features will identify your fintech solution from others? Payment gateways, trading platforms, or mobile banking functionalities?

- Regulatory Compliance: What are the legal and compliance requirements for your product? Compliance with laws like GDPR, PCI DSS, and AML is critical for any fintech product.

Identifying these requirements at the outset ensures your project is designed to meet both user and market expectations.

Key Steps to Start a Fintech Project

Market Research:

Conducting in-depth market research is essential to understanding the competitive landscape and identifying gaps where your fintech solution can add value. Analyze existing products, their strengths and weaknesses, and potential areas where innovation can be introduced.

Understanding Regulations and Compliance:

Regulations are a cornerstone of fintech development. Whether it’s complying with AML, KYC, or data protection laws, ensuring that your product complies with the required standards will prevent future legal issues.

Choosing the Right Technology:

Selecting the appropriate technology stack is critical for the scalability and security of your fintech product. Depending on your product’s goals, you might need to explore technologies such as blockchain, AI, or machine learning to enhance performance and user experience.

Building a Strong Development Team

The quality of your development team can make or break your fintech project. Working with developers who have fintech-specific expertise will save time and avoid costly mistakes.

Consider partnering with developers who understand financial data handling, security protocols, and who can efficiently integrate features like payment gateways and secure APIs. A strong development team is essential to creating a robust, scalable product that can grow with your business.

Designing Your Fintech Solution

An insightful, user-focused design is key to the success of any fintech product. When designing your fintech solution, focus on:

- User Experience: Ensure that the interface is simple and easy to navigate.

- Responsiveness: Your solution must be optimized for both web and mobile users.

- Onboarding: Streamline the onboarding process to make it seamless for users, especially in cases that involve complex financial transactions.

Ensuring Security and Compliance

Security and compliance are non-negotiable in fintech. Make sure that your product incorporates strong encryption, two-factor authentication (2FA), and other security features to protect user data.

Additionally, it’s important to integrate compliance protocols into your product from the start, making sure that financial restrictions in the areas where your product will be used are respected.

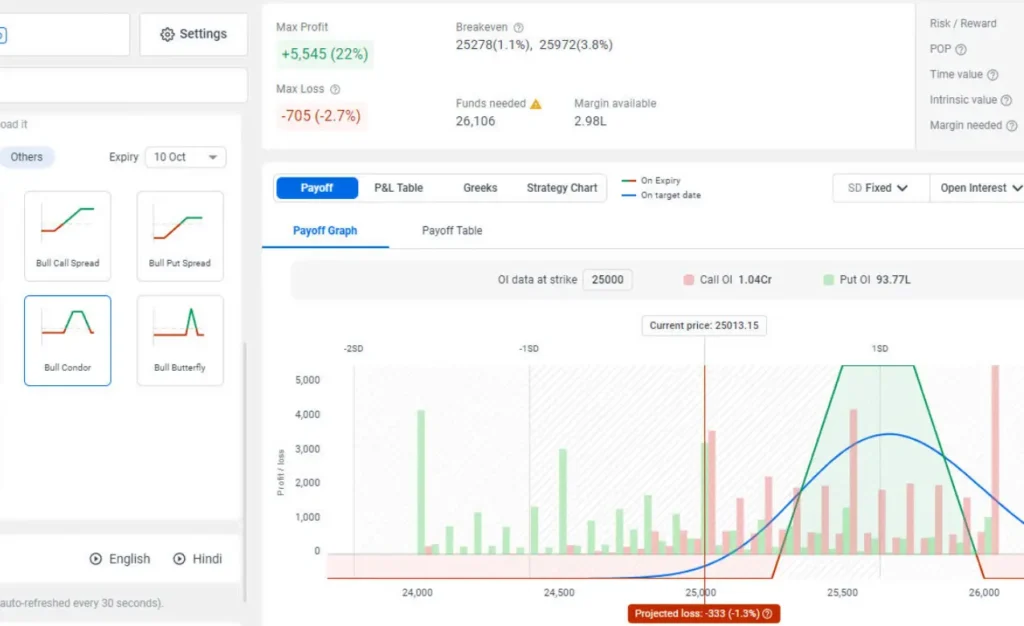

Case Study: Option Trading Strategy & Forecasting Tool

As an example of successful fintech development, we worked on an Option Trading Strategy & Forecasting tool that empowers traders to build and refine custom options trading strategies.

- Historical Data Forecasting: The tool allowed traders to forecast potential outcomes using historical data.

- Risk-Reward Analysis: Users could perform in-depth risk-reward analysis, helping them to make informed decisions.

- Custom Strategy Creation: Traders could select various options and customize their strategies for maximum efficiency.

This tool demonstrates how well-designed fintech products can significantly improve the decision-making process and lead to better outcomes for users.

Launching and Scaling Your Fintech Solution

Launching a fintech product is just the beginning. Continuous user feedback, updates, and scalability are critical to ensuring your product’s long-term success. Ensure that your infrastructure can scale as your user base grows, without compromising on security or performance.

Additionally, leveraging data analytics to track user behavior will provide valuable insights for future iterations and updates, ensuring that your product continues to meet user expectations.

Conclusion

Starting a fintech development project is a complex process that requires a combination of industry expertise, cutting-edge technology, and a deep understanding of compliance and security. By following these steps, you can set the foundation for a successful fintech solution.

If you’re looking for a development team with experience in delivering secure, scalable fintech solutions, feel free to reach out to DC technolabs. We’re here to help you navigate the complexities of fintech development and build a product that stands out in the market.

If you found this blog helpful, check some of the other blogs below:

- Choose the Best Ecommerce Marketing Agency for Your Growth

- How to Find the Best Webflow Development Agency

For more insights and updates on web design for small businesses, follow us on Instagram, Facebook, LinkedIn, and Twitter.